41 zero coupon bonds formula

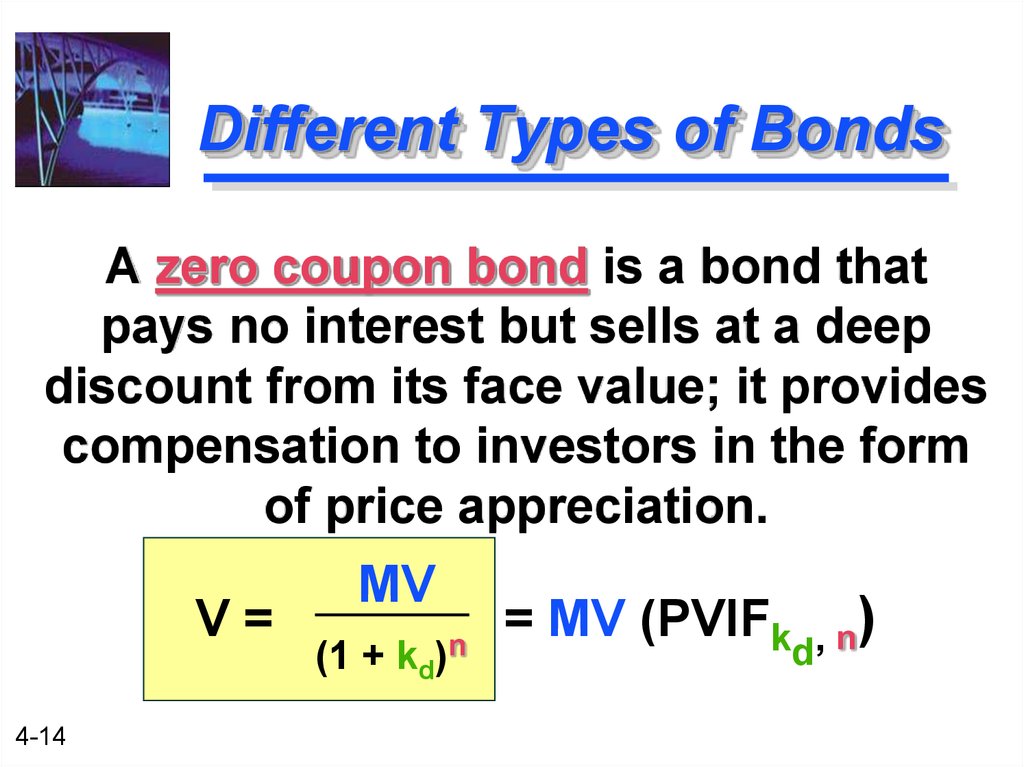

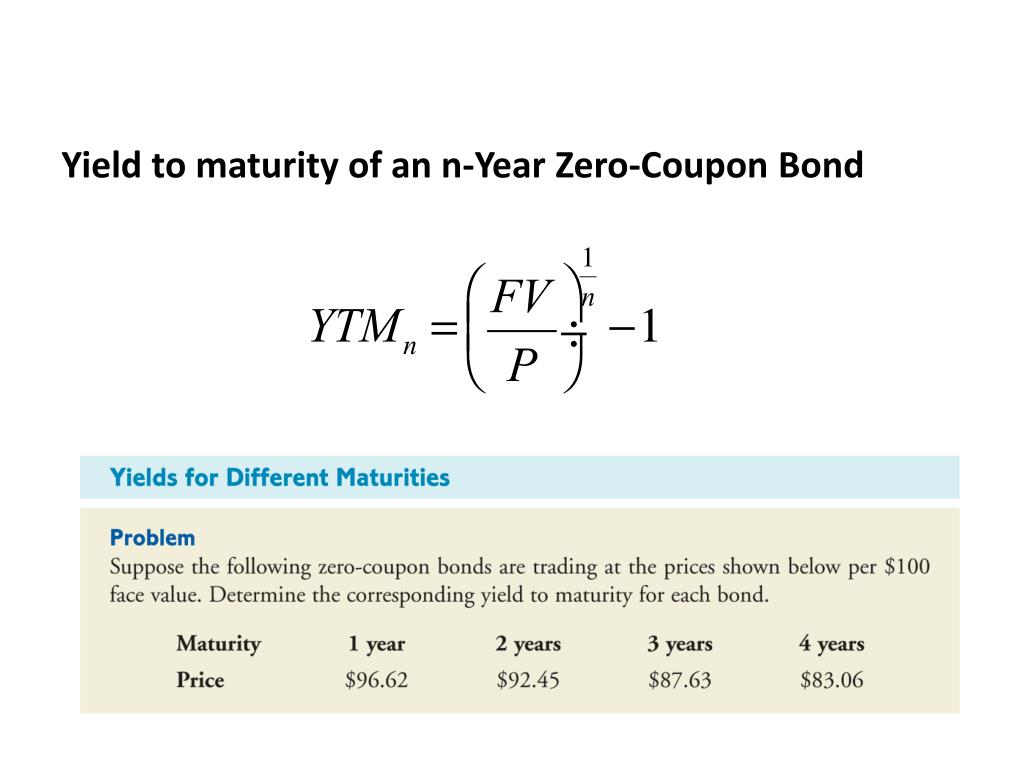

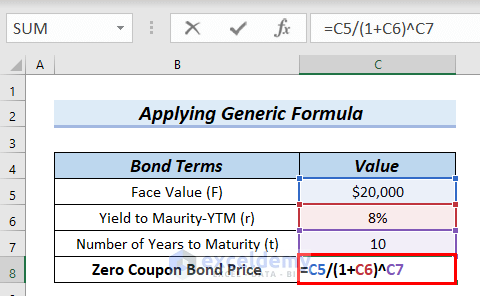

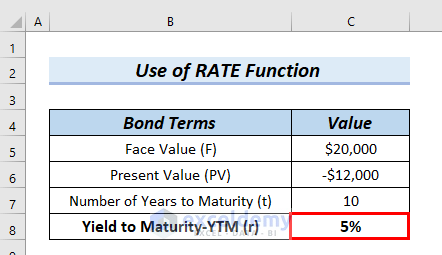

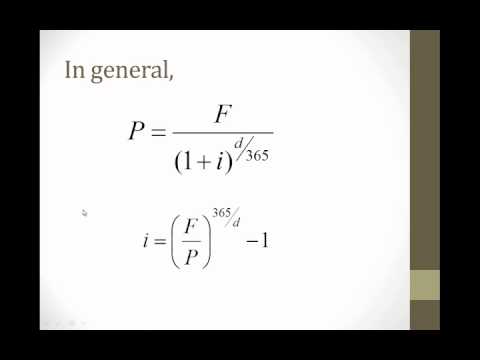

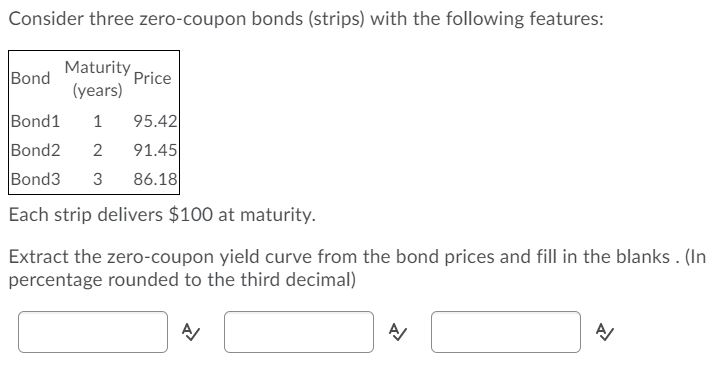

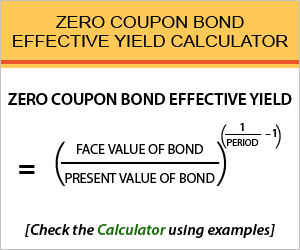

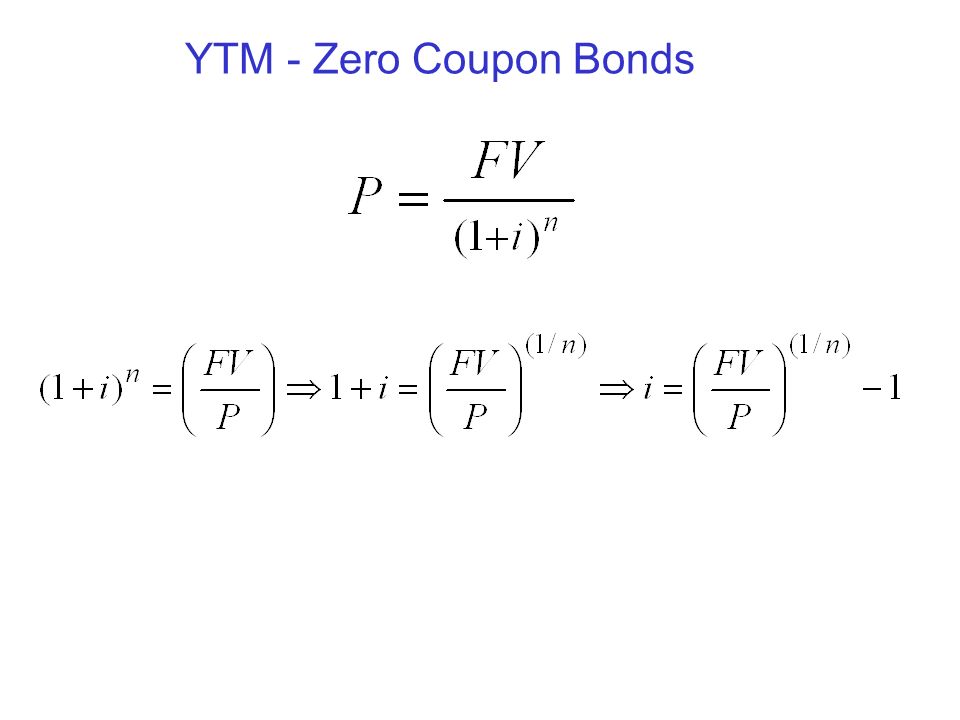

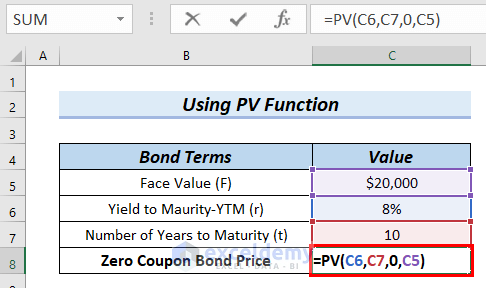

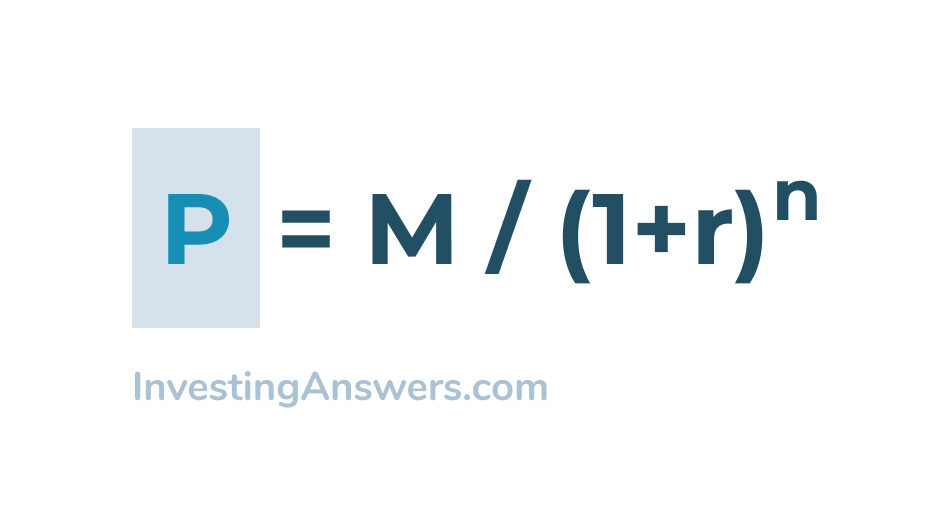

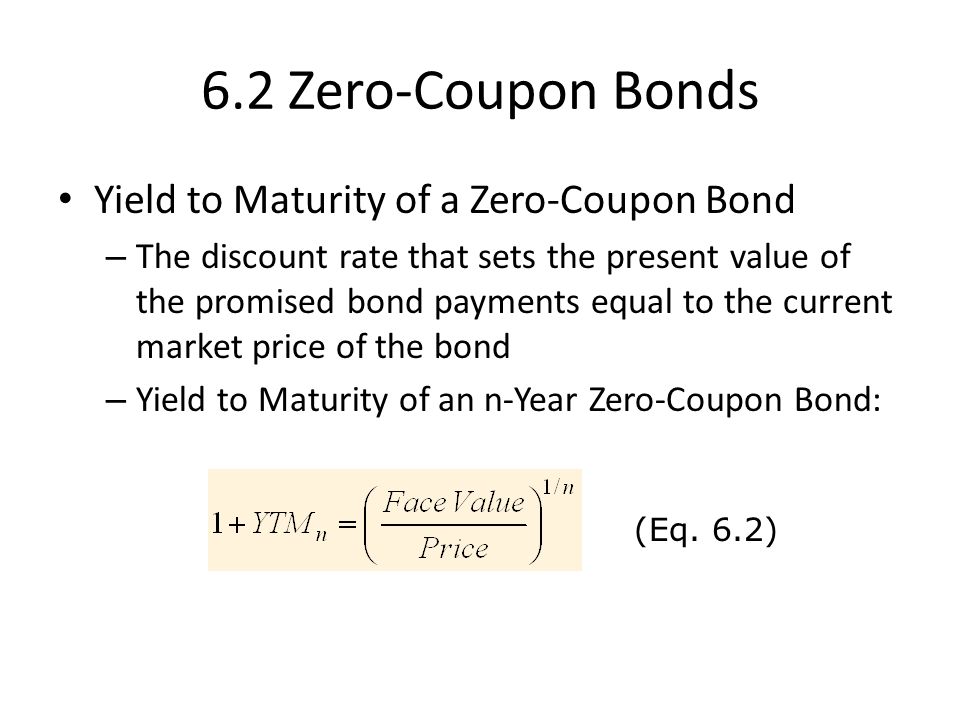

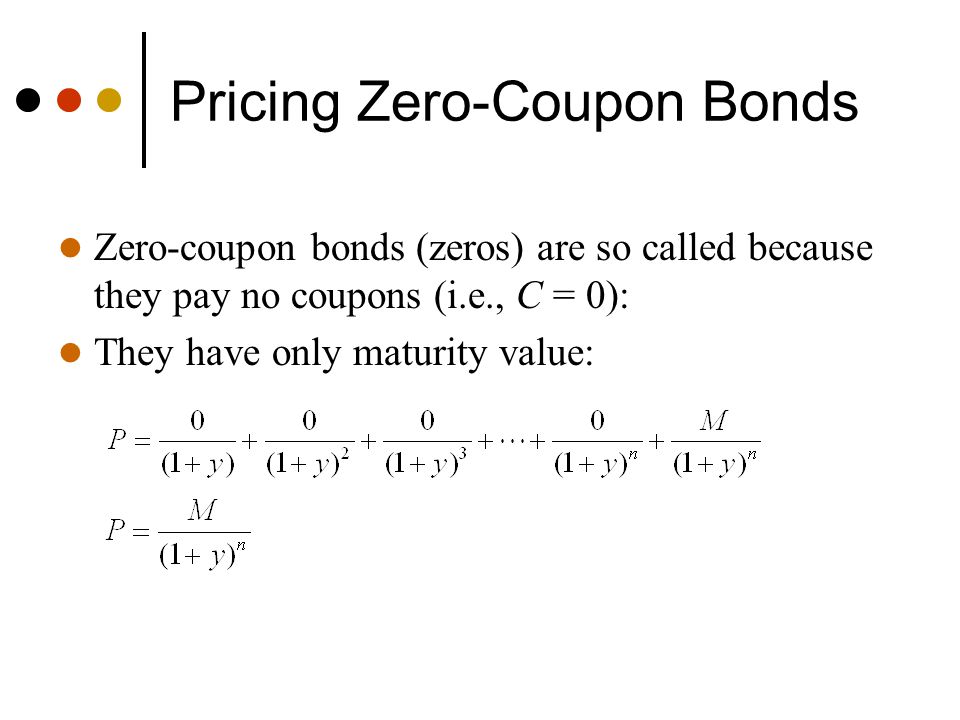

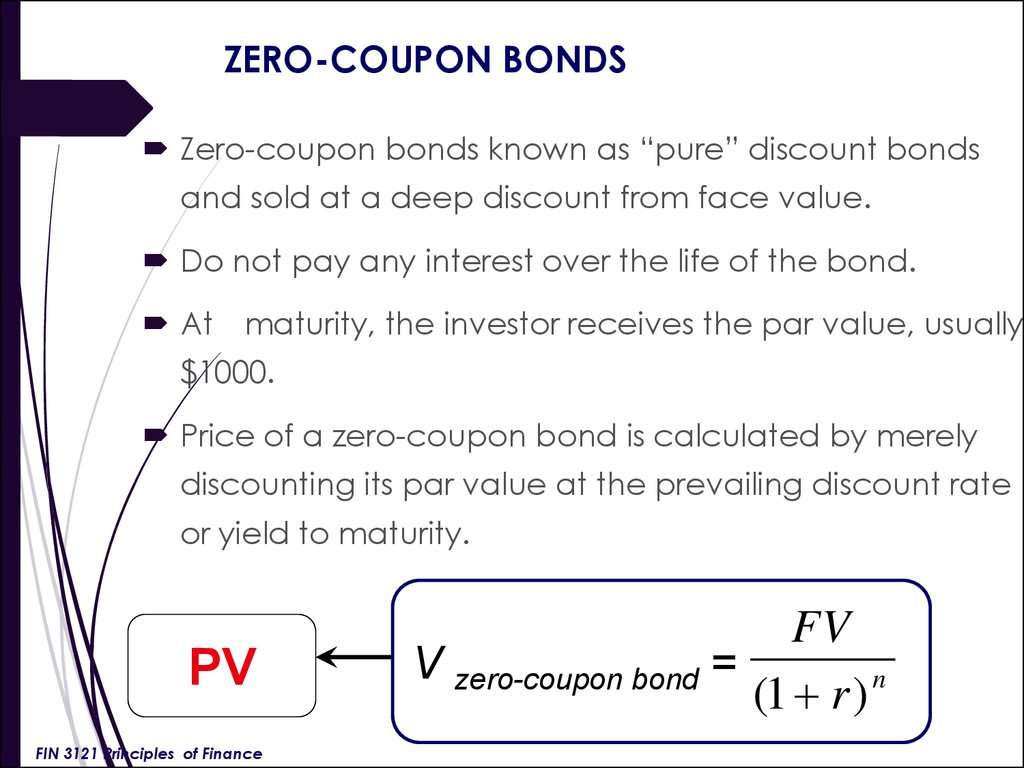

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero coupon bonds are particularly sensitive to interest rates, ... The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in … How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value. ... Zero-Coupon Bond Formula . The formula for calculating the ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping 16.07.2019 · The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ...

Zero coupon bonds formula

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2 ; n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a … Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve …

Zero coupon bonds formula. Zero Coupon Bond Value - Formula (with Calculator) - finance … A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at maturity. The amount paid at maturity is called the face value. The term discount bond is used to reference how it is sold originally at a discount from its face value instead of ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... The Corner Forum - New York Giants Fans Discussion Board ... Big Blue Interactive's Corner Forum is one of the premiere New York Giants fan-run message boards. Join the discussion about your favorite team! Zero-Coupon Bonds: Characteristics and Examples - Wall Street … Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve … Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2 ; n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a …

Post a Comment for "41 zero coupon bonds formula"