41 what does coupon rate mean

School of Electrical Engineering & Computer Science | Washington … When Ukraine connected to the European power grid, WSU technology helped ensure stable electricity interconnections What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

What does fabric count mean in cross stitch? - Stitched Modern But I want to do it 14 count aida but for life of me I can’t work it out. I’ve epilepsy so find maths very hard to do. Could u please work it out for me. It’s a cross stitch designs to make a birthday for a friend. But at this rate I’ll not get it done. Hope u can help me? Thank you Ann

What does coupon rate mean

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean? What does it mean if a bond has a zero coupon rate? - Investopedia A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the...

What does coupon rate mean. What does Coupon Rate mean? - YouTube Marketing Business Network 13.1K subscribers The coupon rate is the annual interest rate paid on a bond. It is represented as a percentage of the bond's face value. This video provides a brief... Coupon-rate Definitions | What does coupon-rate mean? | Best 1 ... Meanings The coupon rate is the rate of interest that is payable on a bond yearly. This rate is determined at the time the bond is purchased and generally does not change. Basically, the higher the coupon rate, the higher the interest payments received from the bond. 0 0 Advertisement Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ... What does: L mean on social media? - Quora Answer (1 of 8): Depending upon on who posted the "L" it could have a variation of meanings but most common ones are example given: *L*. Meaning, "Laughing, laugh, or even love". Most common reference to just posting of the letter L is to weed or pot. Source: Urban Dictionary, L.

What Does Arrears Mean? - Investopedia 14.07.2022 · Arrears refers to either payments that are overdue or payments that are to be made at the end of a period. An account is said to be in arrears if the debt, liability, or obligation expected is ... What does the emoticon :3 mean? - Quora Answer (1 of 29): A symbol meant to represent the cat face made by anime characters when they say something clever, or sarcastic, or are commenting on something cute. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward. Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence.

investing - What do the terms par value, purchase price, call price ... From an accounting standpoint, the coupon rate lowers the amount of real monies paid; the same $1m in bonds, maturing in 10 years with a 5% expected rate of return, but with a 5% coupon rate, now only requires payments totalling $1.5m, and that half-million in interest is paid $50k at a time annually (or $25k semi-annually). What is a Coupon? - Definition | Meaning | Example - My Accounting Course Definition: A coupon, in relation to bond instruments, is an interest payment made to the bondholder during the term of the bond. It is used to compensate the holder for lending their money. What Does Coupon Mean? What is the definition of coupon? The term coupon refers back to when bonds were printed on paper. Population Mean Formula | Calculator (Excel template) - EDUCBA It does not make sense to spend enormous efforts to find a mean of population set. So sample mean is a more realistic and practical concept. Also, mean value, if look it in a silo, has relatively less significance because of the flaws discussed above and it is more of a theoretical number. So we should use mean value very carefully and should ... Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security.

What does mellitus mean in diabetes 2022. 1. 16. · What does mellitus mean in diabetes? (The name diabetes mellitus refers to these symptoms: diabetes, from the Greek diabainein, meaning “to pass through,” describes the copious urination, and mellitus, from the Latin meaning “sweetened with honey,” refers to sugar in the urine.)What Colour is urine in diabetes?Diabetes can cause.

Tracking Support | UPS - Canada What Does My Tracking Status Mean? We put together a list of common tracking statuses to help you track your package and understand better where it's at in its journey. Tracking Statuses Explained. Prevent More Missed Deliveries. Receive up-to-date alerts on incoming packages, see your delivery window and reschedule multiple packages at the same time with UPS My Choice …

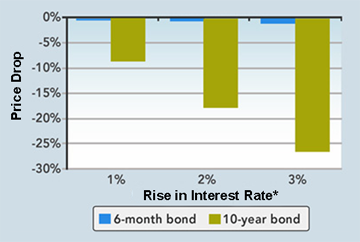

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

What is a Coupon Payment? - Definition | Meaning | Example Definition: A coupon payment is the annual interest payment paid to a bondholder by the bond issuer until the debt instrument matures. In other words, there payments are the periodic payments of interest to the bondholders. What Does Coupon Payment Mean? What is the definition of coupon payment?

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond, although bonds...

What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals. Zero-Coupon Certificates of Deposit

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

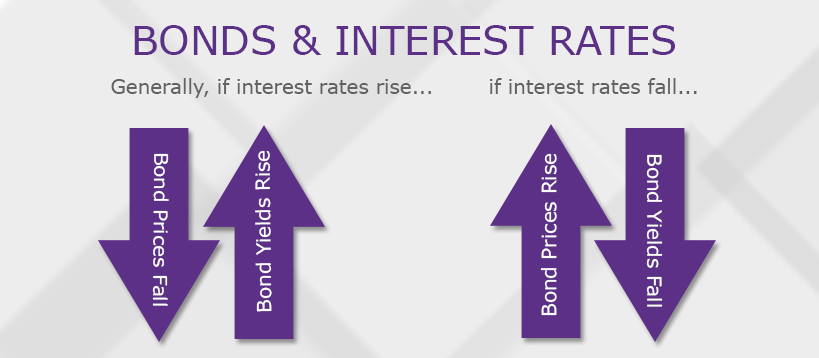

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The yield of a bond changes with a change in the interest rate in the economy, but the coupon rate does not have the effect of the interest rate. Recommended Articles. This has been a guide to the Coupon vs. Yield. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset b. The coupon rate is the fixed annual rate at which a guaranteed-income security, typically a bond, pays its holder or owner. It is based on the face value of the bond at the time of issue, otherwise known as the bond's "par value" or principal.Though the coupon rate on bonds and other securities can pay off for investors, you have to know how to calculate and evaluate this important ...

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

Q: What Does Paid in Arrears Mean? - Gusto 06.11.2019 · What does paying in arrears mean when it comes to accounting? Paying in arrears doesn’t just apply to payroll—it also means paying for goods or services after you receive them. If you work with a vendor who gives you a payment term of net 60, you’ll be billed in arrears, since you have 60 days to pay for the items you received. This means ...

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

Coupon Frequency Definition | Law Insider definition. Coupon Frequency means how regularly an issuer pays the coupon to holder. Bonds pay interest monthly, quarterly, semi - annually or annually. (d) Maturity date is a date in the future on which the investor 's principal will be repaid. From that date, the security ceases to exist.

What does it mean if a bond has a zero coupon rate? - Investopedia A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this does not mean the...

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%.

Post a Comment for "41 what does coupon rate mean"