44 yield to maturity coupon bond

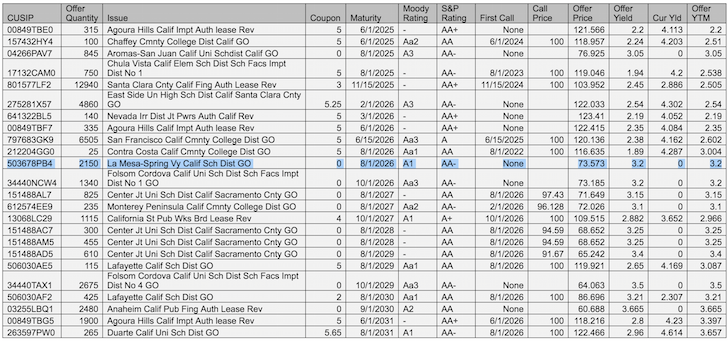

A zero-coupon bond has a yield to maturity of 5% and a par ... A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000. If the bond matures in 16 years, it should sell for a price of ________ today. - 23549548 Bond Dirty Price Calculator - CALCULATOR RUT Yield to maturity % face value $ coupon rate % payments per year. Bond face value is 1000. Clean price stays the same across the life of the bond. And We Find That The Quoted Price Of The Bond Halfway Through The Period Would Be $964.20. To calculate the price for a given yield to maturity see the bond price calculator.

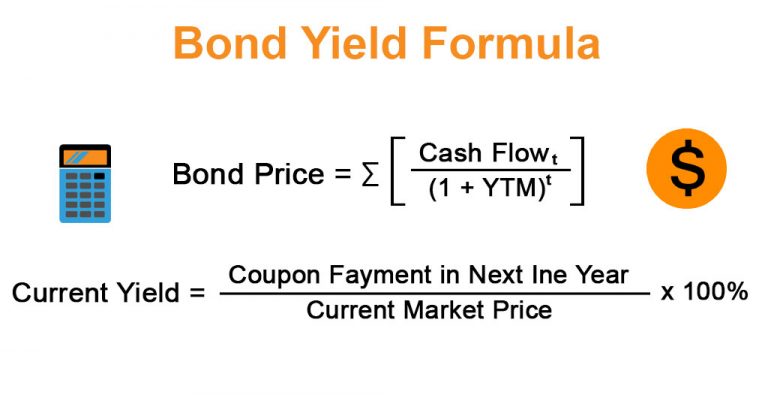

Interest Rate Risk and Currency Risk Management Yield to maturity (YTM) is the annualised rate of return in percentage terms of a fixed income instrument (e. g. ) bond, taking into account coupon rates, frequency of payouts, and capital gains or losses. YTM is fundamentally the interest rate that will make the present value of the cash flows equal to the price.

Yield to maturity coupon bond

Yield to Maturity (YTM) Definition - investopedia.com A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond... Coupon Rate - Meaning, Calculation and Importance Since the coupon rate is higher, bonds become an attractive investment option. It increases the demand, and as a result, the bond prices rise. What is Yield to Maturity? Yield to Maturity (YTM) is the rate of return a bondholder enjoys by holding the bond until maturity. Once the bonds are issued, they are publicly traded in the market like ... THE WALT DISNEY CO. Bond | Markets Insider The The Walt Disney Co.-Bond has a maturity date of 9/1/2029 and offers a coupon of 2.0000%. The payment of the coupon will take place 2.0 times per biannual on the 01.03..

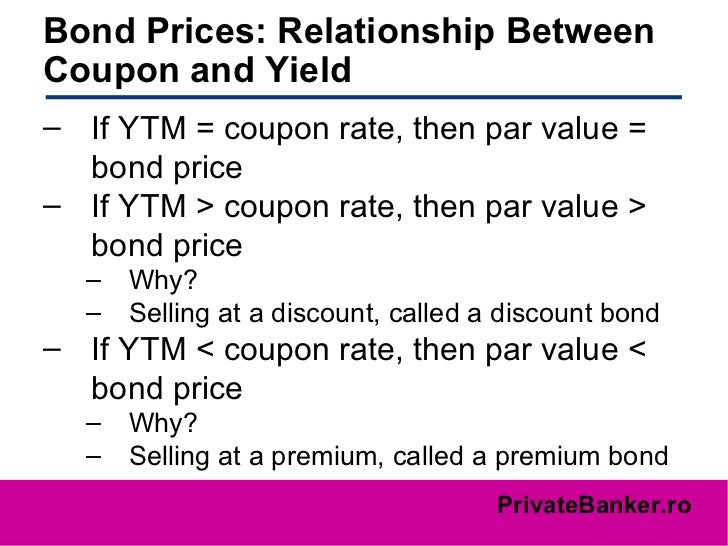

Yield to maturity coupon bond. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Difference Between Bond Yield and Yield to Maturity (With ... In short, a bond yield shows the annual income of investment, whereas yield to maturity is the total predicted yield on a bond till its date of maturation. Bond Yield, or commonly known as yield, designates the revenue return on the bond. In short, a bond yield is calculated by dividing coupon amount (interest) by the price. US 10 year yield moves to a new high going back to ... Bonds. US 10 year yield moves to a new high going back to November 2018. Looks toward the 2019 high at 3.252% Greg Michalowski Friday, 06/05/2022 | 19:54 GMT-0 ... How to calculate yield to maturity manually - Australian ... The stated yield, or nominal yield, is calculating by dividing the amount of interest paid by the face value. The yield to maturity Bond - Yield. 23/06/2011 · Find the yield to maturity on a semiannual coupon bond given that the bond price = 9, the coupon rate = 6%, the face value = 00, and there are 11.

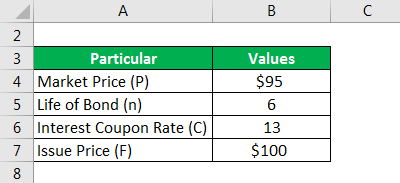

Yield to Maturity | Formula, Examples, Conclusion, Calculator The yield to maturity is the rate of return an investor would earn if they held a bond until it reached maturity. This calculation takes into account the face value, the current price, and any coupon payments that are made. What is the yield to maturity formula? The most common formula used to calculate yield to maturity is: YTM = C + F−P/n / F+P/2 exploringfinance.com › bond-duration-calculatorBond Duration Calculator - Exploring Finance Number of years to maturity is 2; Yield is 8% ; Bond face value is 1000 ; Annual coupon rate is 6% ; Payments are semiannually; Bond price is 963.7; Based on the above information, here are all the components needed in order to calculate the Macaulay Duration: m = Number of payments per period = 2; YTM = Yield to Maturity = 8% or 0.08; PV ... Understanding the Yield to Maturity (YTM) Formula | SoFi The bond will reach maturity in 10 years, with a coupon rate of about 14%. By using this formula, the estimated yield to maturity would calculate as follows: The Importance of Yield to Maturity. Knowing a bond's YTM can help investors compare bonds with various maturity and coupon rates. Yield of a Coupon Bond calculation using Excel. How to ... So just to remember a yield to maturity in case you haven't watched our last article on zero-coupon bonds, the yield of maturity is the rate of return that you would receive on a bond if you buy it at the current price and then hold it until the bond matures. So that rate of return is called the yield or yield to maturity.

Bond Yield: Definition & Calculation with Interest Rates Yield to maturity (YTM): is an investor's expected return after keeping the bond until the maturity date, and it includes all the bond's coupon payments. Yield to maturity is expressed in annual... How to calculate yield to maturity in Excel (Free Excel ... The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. Realized Compound Yield versus Yield to Maturity - Rate Return The investor purchased the bond for par at $1,000, and this investment grew to $1,208. This example highlights the problem with conventional yield to maturity when reinvestment rates can change over time. Conventional yield to maturity will not equal realized compound return. Carry and Roll-Down on a Yield Curve using R code Coupon bond price is calculated easily by using derivmkts R package. We assume that we invest a par coupon bond at time t so that coupon bond price at time t+1 is calculated with time t par yield (coupon rate), t-1 maturity, and time t+1 par yield (discounting).

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A...

Basics Of Bonds - Maturity, Coupons And Yield To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

› calculator › bond_yield_calculatorBond Yield Calculator - Moneychimp Coupon Rate: % Years to Maturity: Results: Current Yield: ... See How Finance Works for the formulas for bond yield to maturity and current yield. Compound Interest

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Calculating Yield to Maturity in Excel - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is held to maturity. There are two formulas to calculate yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / Current Value) (1 / time periods)] -1.

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Post a Comment for "44 yield to maturity coupon bond"